When planning for the future, understanding the difference between a will and a trust is crucial for effective estate planning. Both serve distinct purposes and can be pivotal in ensuring your assets are distributed according to your wishes after your passing. This article aims to demystify these two important legal documents, helping you make informed decisions for your estate planning needs.

What is a Will?

A will, also known as a testament, is a legal document that articulates an individual’s wishes regarding the distribution of their assets and the care of any minor children upon their death. It becomes effective only after the person’s death and must go through probate, a court-supervised process to authenticate the will, pay debts, and distribute the estate to the rightful heirs.

Key Features of a Will:

- Specifies beneficiaries for your assets.

- Names guardians for minor children.

- Requires probate for validation and execution.

- Can be updated as circumstances change.

What is a Trust?

A trust is a fiduciary arrangement that allows a third party, or trustee, to hold assets on behalf of a beneficiary or beneficiaries. Trusts can be arranged in many ways and can specify exactly how and when the assets pass to the beneficiaries. Unlike wills, trusts take effect as soon as they are created and can be used to distribute property before death, at death, or afterwards.

Key Features of a Trust:

- Avoids probate, allowing for a faster distribution of assets.

- Can provide more privacy since it doesn’t become a public record.

- Allows for more control over when and how your assets are distributed.

- Can potentially offer tax benefits and protection against creditors and legal judgments.

Differences Between Wills and Trusts

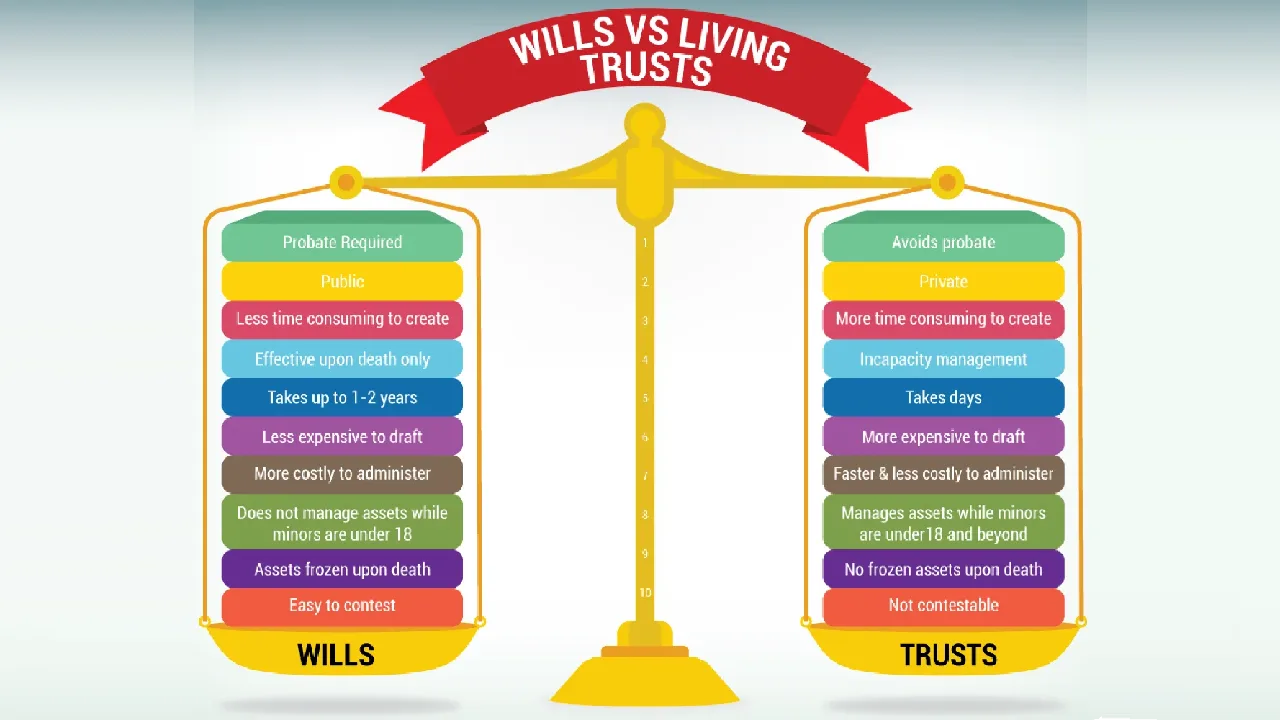

The primary differences between wills and trusts include their activation time, the probate process, privacy concerns, and control over asset distribution. While a will takes effect after death and goes through probate, a trust takes effect as soon as it’s created, offering more privacy and potentially saving time and money by avoiding the probate process.

Which One Do You Need?

Determining whether you need a will, a trust, or both depends on your personal circumstances, assets, and estate planning goals. A will is essential for naming guardians for minor children, while a trust can provide more specific control over asset distribution. It’s not uncommon for an estate plan to include both a will and a trust to cover all bases.

Conclusion

Both wills and trusts are essential tools in estate planning, each serving unique purposes. Understanding the differences between them is the first step in creating a comprehensive estate plan that ensures your wishes are honored. However, given the complexities involved in estate and financial planning, consulting with a professional estate planning attorney is advisable to tailor a plan that suits your specific needs and goals.

Call to Action

Are you ready to start your estate planning but unsure where to begin? Contact our experienced estate planning attorneys today to explore your options and secure your legacy. Remember, the best time to plan for the future is now.